- HOME

- Investor Relations

- Business Policy

- Business and Other Risks

Business and Other Risks

policy

The following is a list of significant risks that management recognizes as having the potential to materially affect the consolidated company’s financial position, results of operations, and cash flows, among other matters related to the business and accounting conditions.

However, these are not an exhaustive list of all the risks facing our Group; other matters not mentioned may also have an impact. Forward-looking statements in this text are based on the Group’s judgment as of the end of the fiscal year 2024.

Recognizing the possibility of these risks occurring, the Group will strive to prevent their occurrence and respond appropriately if they do occur. In addition, considering the impact these risks may have on the Group’s ability to execute its business strategies and its medium- to long-term corporate value, the Group will also strive to strengthen its risk management system and disclose information appropriately.

The JAT Group's Business Base

The Group has been designated as an airport facility operator at Haneda Airport by the Airport Law. As a company that constructs, owns, manages, and operates three passenger terminals and two multi-story parking garages, the Group leases office space and other facilities, operates stores (including food products) and restaurants at the airport, manufactures and sells in-flight meals, and provides travel services.

At Narita Airport and other hub airports, the Group operates merchandise sales, food and beverage services, including producing and selling in-flight meals, real estate leasing, and other businesses that effectively use company-owned land outside of airports. It applies our accumulated experience to develop new businesses inside and outside airport facilities.

Risk Management Structure

For the Group, which is responsible for the construction, management, and operation of passenger terminals of highly public interest, ensuring the continuity of our business is a social mission, and we recognize that in an uncertain society where new risks are emerging, understanding the risks surrounding our business and taking countermeasures are essential issues in ensuring organizational resilience. We recognize that understanding the risks surrounding our business and taking countermeasures are vital in ensuring our organization's strength.

We have established a “Risk Management Committee,” chaired by the President and Representative Director, which aggregates and evaluates company-wide risk information and identifies risks requiring priority countermeasures (hereinafter referred to as “priority risks”). The Risk Management Committee meets regularly (at least twice a year) to confirm the status of countermeasures to priority risks, verify their effectiveness, and evaluate new risks. The details of the deliberations are approved by the Executive Committee and reported to the Board of Directors on a semiannual basis. The Board of Directors oversees the status of risk management. In addition, the Risk Management Committee collaborates with related committees, including the Sustainability Committee and the Compliance Promotion Committee, to promote company-wide risk management that encompasses sustainability-related risks, such as climate change, human rights, and supply chain issues.

Overall risk management process

The Group, led by the Risk Management Committee, implements a risk management process based on the PDCA cycle once a year, and reviews the progress of countermeasures for priority risks every six months.

Plan: Research, identify, and evaluate risks, and develop countermeasure plans

The Risk Management Committee Secretariat conducts a comprehensive risk survey, taking into account the domestic and international socio-economic situation, changes in the business environment, the medium-term management plan, materiality, and other relevant factors. Human rights and environmental risks, in particular, are essential survey items.

The Risk Management Committee evaluates and prioritizes the identified risks based on the “magnitude of impact” and “frequency of occurrence/speed of expansion,” and classifies them into “pure risks,” “strategic risks,” etc.

The responsible risk departments formulate countermeasures for the identified priority risks, and the Risk Management Committee approves them as an annual plan. After confirming consistency at an Executive Committee meeting, the plan will be reported to, discussed, and overseen by the Board of Directors.

Do: Implement the countermeasure plan

The responsible risk departments implement countermeasures in accordance with the approved annual plan.

Check: Monitoring and evaluation

The Risk Management Committee monitors and evaluates the progress and effectiveness of each countermeasure every six months, revising the plan and evaluation criteria as necessary. The results are reported to and overseen by the Executive Committee and the Board of Directors.

Action: Improve and implement the countermeasure plan

Based on the results of the assessment, we formulate and implement measures to improve the countermeasure plan and strive to continuously improve our risk management system.

Information disclosure

This risk management process and the status of countermeasures to major risks are disclosed and communicated in a timely and appropriate manner through this securities report, integrated reports, our website, and other channels.

Group business and other risks

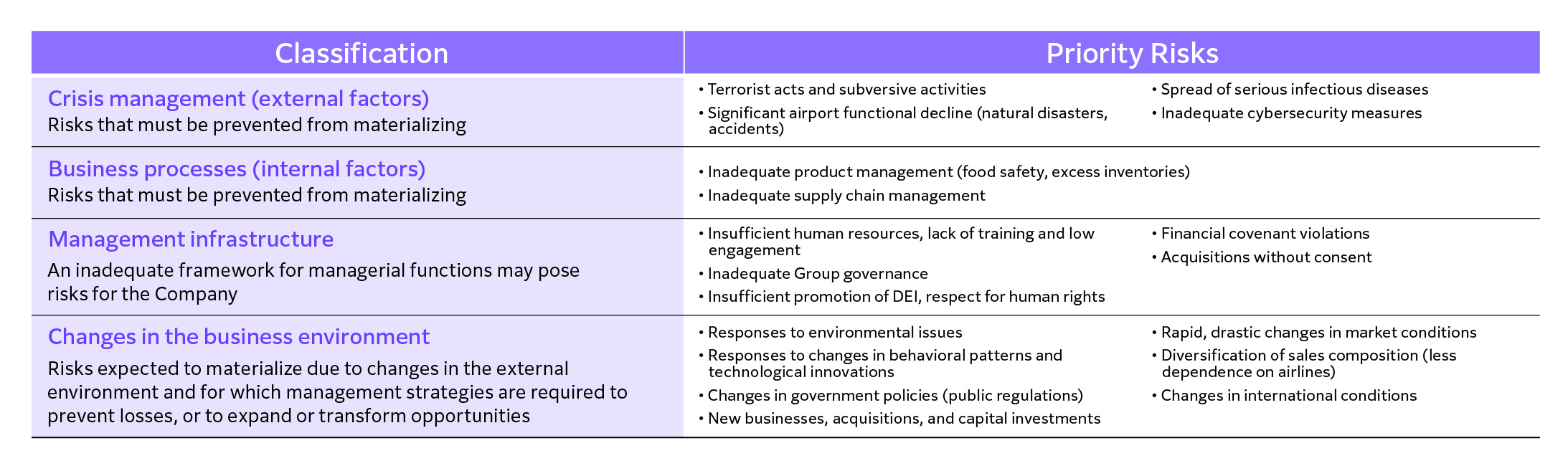

As described in the risk management process, the Group broadly classifies risks into “pure risks” (crisis management, business processes, management infrastructure) and “strategic risks” (changes in the business environment) based on their nature. The concept and overview of this classification are shown in the table below.

According to the classification in the table, the 18 priority risks identified and updated in FY2024, and the main countermeasure status are as follows. We recognize that these could have a significant impact on the Group's management strategy and business continuity, and we are working to minimize the impact.

1. Pure risks

Pure risks are risks that must be prevented from materializing in business operations, and their impact can be minimized through tangible (facilities and equipment), intangible (systems and plans), and human (training) countermeasures. In addition, risks related to the management foundation are themselves risks if they are not properly constructed.

(a) Crisis management (external factors)

- Terrorist and subversive activities

Risk overview: Terrorist and subversive activities at airports or passenger terminals could have a serious impact on business continuity, including causing personal and property damage, as well as halting airport operations and damaging public trust.

Main countermeasures: We are strengthening our security system in cooperation with relevant organizations, and as continuous measures from both the tangible and intangible sides, we are upgrading our security system using the latest technology, strengthening our facilities and equipment, and educating and training our employees.

- Significant deterioration of airport functions (natural disasters/accidents)

Risk overview: If airport facilities and lifelines are severely damaged by natural disasters such as large-scale earthquakes or abnormal weather, or by accidents such as aircraft accidents or large-scale power outages, resulting in the suspension of airport functions for an extended period of time, this could have a significant impact on the business performance and financial position of the Group. In particular, the aircraft collision that occurred at Haneda Airport in January 2024 reminded us of the importance of maintaining airport functions.

Main countermeasures: In addition to steadily implementing long-term repair plans, including promoting earthquake resistance and disaster prevention measures for facilities and duplicating and decentralizing key facilities, we have formulated effective business continuity plans (BCPs), and are verifying and updating them by developing and publicizing disaster countermeasure manuals, conducting practical training, and securing emergency stockpiles. We are also working with relevant organizations to strengthen our countermeasure system in the event of an aircraft accident.

- Serious infectious disease outbreaks

Risk overview: The outbreak and spread of new infectious diseases both domestically and internationally could have a wide-ranging and long-term impact on the Group's overall business activities through travel restrictions, a significant decrease in air travel demand, and a reduction in business operations due to employee infections.

Main countermeasures: We are continuously implementing infection prevention measures with the safety of our passengers and employees as our top priority. These include utilizing contactless technology, implementing thorough hygiene management within our facilities, and strengthening infection prevention measures for our employees. We are also working to thoroughly publicize our action plan based on the infectious disease countermeasure BCP and to build a flexible business operation system that can respond to fluctuations in air travel demand.

- Inadequate cyber-security measures

Risk overview: The threat of cyber attacks is becoming increasingly sophisticated and devious, including the leakage of confidential information held by the Group, such as customer information, technical information, and management information, the shutdown of core systems, and ransomware attacks. These attacks may result in disruption to business operations, loss of public trust, economic loss, legal liability, etc.

Main countermeasures: We have established JAT-CSIRT (Cybersecurity Incident Response Team), headed by the executive in charge of the Digital Business Promotion Office, and are promoting a 24/7 monitoring system, the development and training of IT-BCP, and strengthening cooperation with external specialist organizations.

(b) Business processes (internal factors)

- Inadequate product management (food safety, excess inventory)

Risk overview: If quality assurance issues such as food poisoning or foreign matter contamination occur in food sales at airport stores, restaurant operations, or in-flight meal production, it could lead to damage to customer health, administrative sanctions, damage to brand image, and reduced sales. Furthermore, improper inventory management can lead to a worsening of cash flow and an increase in waste loss, which can lead to an increased environmental impact.

Main countermeasures: We are strengthening our quality control system based on hygiene management methods, providing thorough hygiene education to employees, and strengthening supplier management. We are working to improve the accuracy of supply and demand forecasts, maintain appropriate inventory levels, and reduce food waste.

- Deficiencies in supply chain management

Risk overview: The Group's business activities depend on many domestic and overseas business partners. Disruptions or confusions to the supply chain due to natural disasters, infectious diseases, geopolitical risks, human rights violations (forced labor, child labor, etc.), and strengthened environmental regulations could lead to difficulties in procuring products and raw materials, rising costs, and a damaged reputation.

Main countermeasures: We have established a Supply Chain Subcommittee under the Sustainability Committee to promote ESG programs for suppliers. Specifically, we are working to strengthen and improve the sustainability of our entire supply chain by formulating sustainable procurement standards and requesting compliance, and by conducting surveys and dialogue with business partners as part of our human rights due diligence to confirm compliance.

(c) Management infrastructure (human capital and finance)

- Insufficient human capital and training, low engagement

Risk overview: As the labor force declines due to the declining birthrate and aging population, and working styles become more diverse, competition is intensifying to acquire the human capital necessary for business expansion and maintaining service quality. A shortage of human capital, delays in training, and declining employee engagement could lead to a decline in competitiveness in the medium- to long-term through restrictions on store operations, delays in the promotion of new businesses, hindrances to innovation, and a deterioration of corporate culture.

Main countermeasures: Based on the Medium-Term Management Plan and the Medium-Term Sustainability Plan, we are working to establish a personnel structure through strategic recruitment activities and to enhance our training system, under the policy of developing “human capital who think for themselves and take on challenges.” We are also promoting the creation of a rewarding working environment through measures such as the introduction of a dual-track personnel system, the holding of various seminars, and the operation of a mentor system. We use the results of the employee engagement survey to identify issues and develop improvement measures, and manage the effectiveness of our human capital measures using the PDCA cycle.

- Insufficient group governance

Risk overview: The Group operates a wide range of businesses through multiple group companies, and it is essential to promote a unified management strategy for the entire group and ensure the effectiveness of internal control systems. If there is a lack of information sharing among group companies, if headquarters policies are not fully understood, or if any fraudulent activities or compliance violations occur at any of the group companies, this could lead to a loss of credibility for the entire group and a decline in management efficiency.

Main countermeasures: We are promoting the PDCA cycle for the development and operation of the Group’s internal controls, and are working to ensure that the “Basic Compliance Guidelines” and “Code of Conduct,” which were fully updated in FY2024, are disseminated and thoroughly implemented among all Group employees. We are continually working to strengthen our group governance system through measures such as monitoring the business status of group companies.

In addition, based on the investigation report of the Special Investigation Committee published on May 9, 2025, we will promptly consider and implement the various recurrence prevention measures described in the “Notice Regarding the Formulation of Recurrence Prevention Measures and Disciplinary Actions against Directors” dated June 12, 2025.

- Lack of DEI promotion and respect for human rights

Risk overview: Delays in Diversity, Equity & Inclusion (DEI) initiatives and the occurrence of human rights violations (forced labor, child labor, harassment, etc.) throughout business activities, including the supply chain, could lead to a decline in employee motivation, a decrease in competitiveness in recruiting, damage to the company’s image, a decline in evaluations from customers and investors, and boycotts and lawsuits.

Main countermeasures: Under the slogan “Build a corporate culture where diverse human capital can enhance each other,” we are strengthening our DEI promotion system, conducting various training programs, setting up consultation desks, and creating a comfortable working environment. We have formulated a “Human Rights Policy,” established and are operating a system for human rights due diligence, and are encouraging our suppliers to respect human rights as well. We have established a policy against customer harassment to ensure employee peace of mind and improve the quality of our work.

- Violation of financial covenants

Risk overview: If the Group breaches the financial covenants in its loan agreements with financial institutions due to an increase in interest-bearing debt resulting from large-scale capital investments or a significant deterioration in profitability, it may be required to repay the loan in full, which could have a significant impact on the Group’s cash flow and financial position.

Main countermeasures: We are working to steadily operate our business and strengthen profitability based on our Medium-Term Management Plan, make investment decisions with an awareness of capital costs, and generate stable cash flows. We regularly monitor our financial situation, confirm monthly income and expenditures and cash trends, and strengthen information sharing with group companies, financial institutions, auditing firms, etc.

- Acquisitions without Consent

Risk overview: If a party that harms the corporate value of the Group and the common interests of shareholders attempts to acquire management control through a large-scale purchase of the Company’s shares or other such actions, this could have a significant impact on the Group’s management policies.

Main countermeasures: We strive to continuously improve our corporate value and the common interests of our shareholders, and we also promote constructive dialogue with shareholders in normal times, promoting activities to deepen their understanding of our management policies. We will continue to implement takeover defense measures based on the resolutions of the General Meeting of Shareholders, and we are also taking measures that emphasize communication with stakeholders, such as strengthening engagement with institutional investors, determining policies regarding cross-shareholdings, and analyzing trends among major shareholders. Regarding our policy for dealing with large-scale purchases, we are reviewing the appropriateness of such actions and specific countermeasures.

2. Strategic risks

Strategic risks are risks that are expected to materialize due to changes in the external environment and require management strategies to prevent losses or expand or transform opportunities.

(d) Changes in the business environment (Management strategies to respond to changes in the external environment)

- Addressing Environmental Issues

Risk overview: Physical risks (damage to facilities due to extreme weather, etc.) and transition risks (tighter regulations such as the introduction of a carbon tax, increased costs for energy conservation and renewable energy, growing demands for decarbonization from customers and society, etc.) associated with climate change may increase the Group's business operating costs, increase the burden of capital investment, lower corporate valuation, and have an adverse effect on fundraising. Similar risks are also expected if efforts to reduce environmental impact, such as waste disposal and water resource use, are insufficient.

Main countermeasures: Based on the Mid-Term Sustainability Plan, we are promoting the expansion of renewable energy, the introduction of energy-saving equipment, and the conversion of airport vehicles to electric vehicles, with the aim of achieving net zero by 2050. In addition, we strive to properly dispose of and reduce waste based on the 3Rs (reduction, reuse, and recycling), and promote thorough waste separation and improved recycling rates. We are working to reduce water consumption and use it efficiently by installing water-saving equipment and utilizing rainwater and recycled water.

- Slow response to changes in behavior and technological innovation

Risk overview: Passenger behavior and related technologies are constantly changing, with structural changes in business aviation demand due to the spread of online meetings and the establishment of new working styles such as workation, changes in purchasing behavior at airport stores due to the increased use of e-commerce sites and the advancement of cashless payments, and the rapid development of automation and labor-saving technologies. If we are slow to respond to these changes, our existing business models may become obsolete and our competitiveness may decline.

Main countermeasures: By accurately grasping changes in customer needs and market trends, we are working to introduce contactless technology, expand online services, provide personalized services based on data analysis, and promote the creation of a smart airport based on our DX (digital transformation) strategy. We are proactively taking on the challenge of utilizing new technologies to improve operational efficiency and develop new services, and are promoting business transformation by viewing change as an opportunity.

- Change in policy (public regulation)

Risk overview: Changes in laws, regulations, and policies relating to airport management and operation, security, environment, labor, etc., as well as the introduction of new regulations, may affect the business activities and investment plans of the Group. In particular, the trend toward airport management reforms being promoted by the Ministry of Land, Infrastructure, Transport and Tourism has the potential to bring about major changes in the business environment.

Main countermeasures: Through cooperation with relevant government ministries and industry associations, we are constantly gathering information on policy trends and preparing to respond quickly to regulatory changes, etc. We are also actively working to meet societal demands, such as strengthening aviation security systems and contributing to efficient airport operations.

- New business, acquisitions, and capital expenditures

Risk overview: Entry into new businesses, M&A, and large-scale capital investments undertaken as part of growth strategies involve risks such as not achieving the expected results, prolonged investment recovery, or failure to achieve business plans due to changes in the market environment, etc. Overseas businesses also face country risks such as political instability and changes in legal systems.

Main countermeasures: With regard to investment projects, we recognize the importance of business evaluation with an awareness of capital costs, and are currently considering specific investment decision-making criteria and a framework for return management after conducting sufficient market research, business feasibility evaluation, and risk analysis.

- Abrupt and large fluctuations in market conditions

Risk overview: Rising raw material and energy prices, sudden fluctuations in exchange rates, rising interest rates, etc., may affect the Group’s profitability and financial position through increases in procurement costs, operating expenses, and capital investment, as well as a decline in customer purchasing power. We must also keep a close eye on rising resource prices and supply chain disruptions caused by factors such as the prolonged situation in Russia and Ukraine.

Main countermeasures: We are continuing to implement measures to hedge against price fluctuation risks by diversifying our suppliers and to reduce costs through efficient inventory management. We are building a system that closely monitors economic trends and the market environment and flexibly reflects them in our business plans and pricing strategies.

- Diversification of sales mix (easing airline dependence)

Risk Overview: The Group’s revenues are highly dependent on the number of air passengers and the business activities of airlines. In the event of a sudden drop in air travel demand due to a resurgence of infectious diseases, international conflict, economic downturn, etc., if the revenue base from non-aviation related businesses (such as businesses outside airports) is not sufficiently established, there is a risk that business results will fluctuate significantly.

Main countermeasures: Based on the Medium-Term Management Plan, we are contributing to strengthening the functions of Haneda Airport while promoting the creation of new revenue opportunities (airport-area development, digital platform businesses, participation in overseas airport management businesses, etc.) by leveraging the know-how we have cultivated through our past businesses.

- Changes in the International Situation

Risk overview: Increased geopolitical risks (e.g., a deterioration in Japan-China relations due to an emergency in Taiwan), conflicts between nations, frequent occurrences of terrorism, the rise of protectionist policies, etc. could affect the Group's business through stagnation of international travel and logistics, a decrease in demand for international flights, and disruptions to the supply chain.

Main countermeasures: We are continuously monitoring major international situations and trends in each region, and strengthening our information gathering and analysis systems.

Future-oriented risk management

In addition to the risks mentioned above, the Group will continue to monitor new risks (emerging risks) that may materialize in the future, and will strive to identify them early and respond promptly. Our policy is to continually review our risk management system and processes in line with changes in the business environment and the growth of our group, in order to improve their effectiveness. Through these efforts, we aim to achieve sustainable growth and increase corporate value, even in a highly uncertain business environment.