- HOME

- Investor Relations

- Business Policy

- Corporate Governance

Corporate Governance

policy

Basic Policy

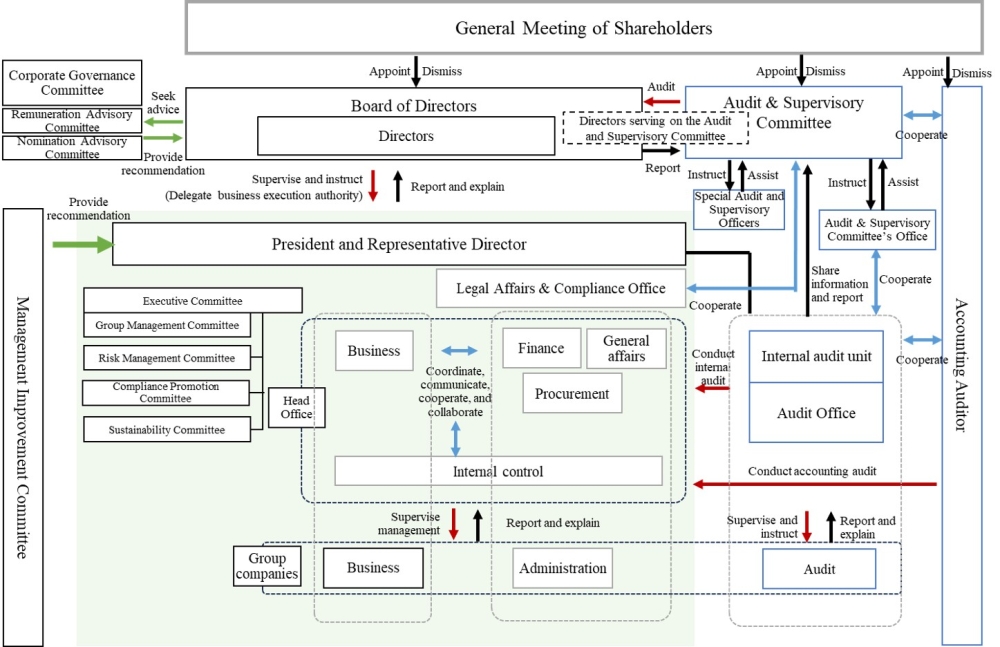

Recognizing that corporate governance is an important management issue, the Company has appointed outside directors to ensure management transparency since its establishment. Previously, the Company had a system of Board of Statutory Auditors. However, with the approval of an amendment to the Articles of Incorporation at the 78th Ordinary General Meeting of Shareholders held on June 24, 2022, the Company became a company with an Audit & Supervisory Committee system. The Board of Directors, which generally meets once a month, consists of 15 directors (including 7 full-time directors and 8 part-time outside directors, including 6 independent outside directors) and makes decisions on basic management policies, matters prescribed by laws and regulations and other important management matters, and supervises the conduct of business. The Audit & Supervisory Committee consists of three independent outside directors and members of the Audit & Supervisory Committee, who attend the meetings of the Board of Directors and other important meetings to monitor the legality and appropriateness of the directors' performance of their duties, as well as the transparency and soundness of management.

Basic Policy and Implementation of the Internal Control System

Basic Policy

The Company has established a company-wide internal control system, including group companies, to enhance the effectiveness and efficiency of business management, ensure the reliability of corporate financial reporting, and encourage compliance with laws and regulations regarding business management.

Status of Maintenance

1. Systems to ensure that the execution of duties by directors, executive officers, and employees comply with laws, regulations, and the Articles of Incorporation

(i) The Company issues the Compliance Declaration to express its determination to make group-wide efforts to improve compliance, establishes a code of conduct for directors and employees by the Basic Compliance Guidelines, and has established a system to promote compliance, including the establishment of a Compliance Promotion Committee chaired by the President and Representative Director and composed of the presidents of each subsidiary company by the Compliance Promotion Committee Regulations.

(ii) Establish a compliance information desk (reporting system) to prevent the occurrence of illegal acts, etc., and minimize the impact on the Company if such acts should occur.

(iii) The Compliance Control Division shall take the lead in holding training sessions and explanatory meetings to ensure thorough compliance.

(iv) The Company shall establish regulations for the Board of Directors and the Management Committee and establish a system to report the status of execution of duties by each director at these meeting bodies.

(v) The Company shall establish various internal rules based on laws and regulations and the Articles of Incorporation, such as organization rules and employment rules, and establish a system to ensure the execution of duties by such internal rules and regulations.

(vi) Establish a system to audit the status of execution of duties in each department by the internal audit department.

2. System for storage and management of information related to the execution of duties by Directors

Information related to the execution of duties by Directors shall be appropriately stored and managed by the internal rules for document management.

3. Rules and other systems for managing the risk of loss

(i) To develop a system for risk management, the Company shall establish basic rules related to the management of the risk of loss and other systems for the entire Group.

(ii) The internal audit department shall periodically identify risks in each department and provide risk information, which shall be managed by each department.

(iii) For company-wide risks and other risks that are deemed to be of high importance, each department, led by the Corporate Planning Department, shall compile countermeasures to prevent such risks and report them to the Executive Committee and the Board of Directors as appropriate.

4. System to ensure the efficient execution of duties by directors

(i) The Board of Directors shall meet once a month in principle by the Board of Directors Regulations, and once every 3 months in principle at subsidiaries, to make decisions on basic management policies, matters required by law, and other important management matters, and to supervise the execution of business operations.

(ii) The "Management Committee," attended by full-time directors and executive officers, etc., shall meet once a week in principle based on the Management Committee Regulations, and twice a month at subsidiaries, to deliberate basic policies and important matters related to business execution based on management policies decided by the Board of Directors, and supervise overall business operations.

(iii) The Company shall establish organizational rules to ensure the reliable and efficient operation of the duties of the Directors.

(iv) The Company shall establish the Rules of Administrative Authority to clarify the responsibilities and authority of each position concerning the execution of the Company's business and ensuring the efficient and organized management of the Company's business.

(v) After April 1, 2009, the Company shall introduce an Executive Officer System and reorganize the "Managing Directors' Meeting" into the "Executive Committee" to separate supervision and execution and accelerate decision-making, as well as to improve the executive function, and Executive Officers shall be able to attend such meetings.

5. System to ensure the appropriateness of operations of the corporate group consisting of the Company and its subsidiaries

(i) The Company shall establish the Affiliated Companies Management Regulations, which stipulate basic policies regarding the management of subsidiaries by the parent company and the appropriateness of operations between the parent company and subsidiaries, and establish a system to ensure the appropriateness of the execution of business by group companies.

(ii) By the Affiliated Companies Management Regulations, the Company shall establish a Group Management Committee to advance comprehensive business as a group and strengthen the development of subsidiaries, and shall receive regular reports on the status of business execution, etc.

(iii) The "Basic Compliance Guidelines" stipulate that the Company and its subsidiaries shall not have any relationship with antisocial forces that threaten social order and safety and shall not respond to any unreasonable or illegal demands, provided that the Company and its subsidiaries shall act appropriately by social rules and ethical standards.

(iv) The Company and its subsidiaries shall conduct the necessary documentation, testing, and other activities, and evaluate the effectiveness of these activities in response to the internal control reporting system for financial reporting based on the Financial Instruments and Exchange Law. In addition, the Company shall establish an Internal Control Promotion Office to promote these activities and enhance internal control over financial reporting.

(v) The Internal Audit Department shall establish a system to audit the status of business execution of subsidiaries.

6. System for reporting to the Audit and Supervisory Committee by directors (who are excluding Audit and Supervisory Committee members), executive officers, and employees, and system for reporting to the Company's Audit and Supervisory Committee by directors, corporate auditors, and employees of subsidiaries or persons who receive reports from them

(i) Directors, executive officers, and employees shall report to the Audit and Supervisory Committee on internal control matters regularly and whenever important matters arise, and the Audit and Supervisory Committee may request reports from directors, executive officers, and employees (including those of subsidiaries) as necessary.

(ii) The Audit and Supervisory Committee shall always have access to important minutes and approved documents.

(iii) Directors, corporate auditors, and employees of subsidiaries, or directors, corporate officers, and employees of the Company who receive reports from them on matters concerning internal controls or important matters, etc., shall report to the Audit and Supervisory Committee.

7. System to ensure that a person who reports to the Audit and Supervisory Committee as described in (6) above will not receive any disadvantageous treatment because of such a report

The contents of reports shall be treated confidentially, and no disadvantageous treatment shall be accorded to those who make such reports by the Basic Compliance Guidelines.

8. Matters Concerning Directors and Employees Assisting the Audit and Supervisory Committee

The Company shall assign employees to assist the Audit and Supervisory Committee in its duties. In addition, Special Audit & Supervisory Officers shall be selected to assist the Audit and Supervisory Committee in its duties.

9. Matters concerning the independence of the directors and employees mentioned in (8) above from the Company's directors and matters concerning the effectiveness of instructions given by the Audit and Supervisory Committee to such directors and employees

If full-time employees assigned to assist the duties of the Audit and Supervisory Committee are assigned to positions independent from Directors, the Company shall ensure their independence from Directors and the effectiveness of the Audit and Supervisory Committee's instructions by, for example, holding prior discussions with the Audit and Supervisory Committee regarding personnel transfers, etc.

10. Matters concerning procedures for advance payment or reimbursement of expenses incurred in connection with the execution of duties by Audit and Supervisory Committee members (limited to those related to the execution of duties by the Audit and Supervisory Committee) and matters concerning the policy for the treatment of expenses or liabilities incurred in connection with the execution of duties by Audit and Supervisory Committee members (limited to those related to the execution of duties by the Audit and Supervisory Committee)

If an Audit and Supervisory Committee member requests the Company to pay expenses or settle debts incurred in the execution of the duties of Audit and Supervisory Committee members (limited to those related to the execution of the duties of the Audit and Supervisory Committee), the Company shall pay such expenses or debts to the Audit and Supervisory Committee members except when it is deemed that the request is not necessary for the execution of duties of Audit and Supervisory Committee members (limited to the execution of duties of the Audit and Supervisory Committee).

11. Other systems to ensure the effective execution of audits by the Audit and Supervisory Committee

(i) The Audit and Supervisory Committee shall maintain close cooperation with the Internal Audit Department and establish a system to utilize the results of internal audits.

(ii) Audit and Supervisory Committee members shall be able to attend important meetings to understand important decision-making processes and the status of business execution.

Pattern Chart