- HOME

- Investor Relations

- Stock Information

- Dividends

Dividends

Stock Information

Dividend Policy

JAT views the return of profits to shareholders as one of its most important responsibilities and will take a more proactive approach to management and strive to improve our business performance. Our basic policy is to continue to pay stable dividends while securing internal reserves in consideration of major investments such as the replacement of passenger terminal facilities to accommodate the functional expansion of Haneda Airport. In addition, JAT has set a dividend payout ratio of 30% or more as a target index in its medium-term business plan to actively return profits to shareholders in line with business performance.

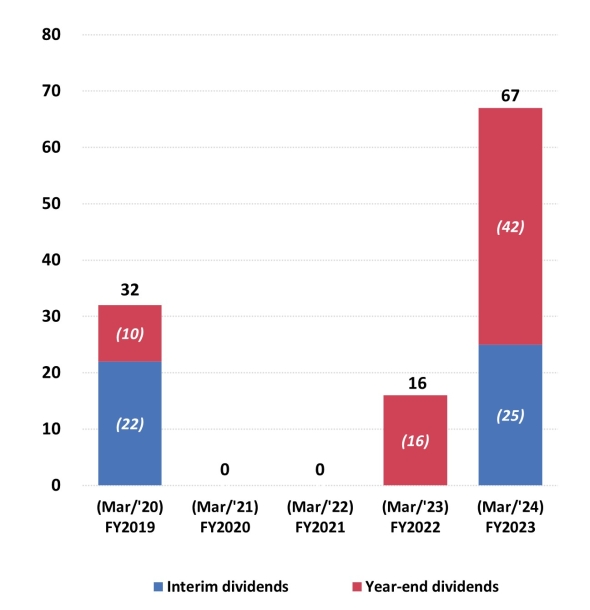

In accordance with our basic policy, we distribute surplus funds twice a year in the form of interim dividends and year-end dividends. Our Articles of Incorporation provide for the payment of interim dividends stipulated in Article 454, Paragraph 5 of the Companies Act.

This distribution of surplus is decided by the resolution of the General Meeting of Shareholders as to year-end dividends and by the resolution of the Board of Directors as to interim dividends.

Dividend Data

| FY2020 (Mar/'21) |

FY2021 (Mar/'22) |

FY2022 (Mar/'23) |

FY2023 (Mar/'24) |

FY2024 (Mar/'25) |

|

|---|---|---|---|---|---|

| Dividends per share (yen) | 0 | 0 | 16 | 67 | 90 |

| Interim dividends | ( - ) | ( - ) | ( - ) | (25) | (35) |

| Year-end dividends | ( - ) | ( - ) | (16) | (42) | (55) |

| Dividend payout ratio | - | - | - | 32.4 | 30.5 |