- HOME

- Investor Relations

- Business Policy

- Business and Other Risks

Business and Other Risks

policy

Matters that could significantly impact the judgments of investors are discussed below.

However, these are not an exhaustive list of all risks related to the Group, and other matters not mentioned may have an impact.

Among the matters discussed below, those concerning the future have been identified based on judgments made by the JAT Group as of the end of the fiscal year 2022.

The JAT Group's Business Base

The Group has been designated as an Airport Facility Operator at Haneda Airport in accordance with the Airport Law. As a company that constructs, owns, manages and operates three passenger terminals and two multi-story parking garages, the Group leases office space and other facilities, operates stores at the airport for the sale of products (including food products) and restaurants, and manufactures and sells in-flight meals and provides travel services.

At Narita Airport and other hub airports, the Group operates merchandise sales and food and beverage services, including the production and sale of in-flight meals, as well as real estate leasing and other businesses that make effective use of company-owned land outside of airports. The Group also leases to other parties commercial real estate it owns outside of airports, and apply experience we have accumulated over the years to develop new businesses both inside and outside airport facilities.

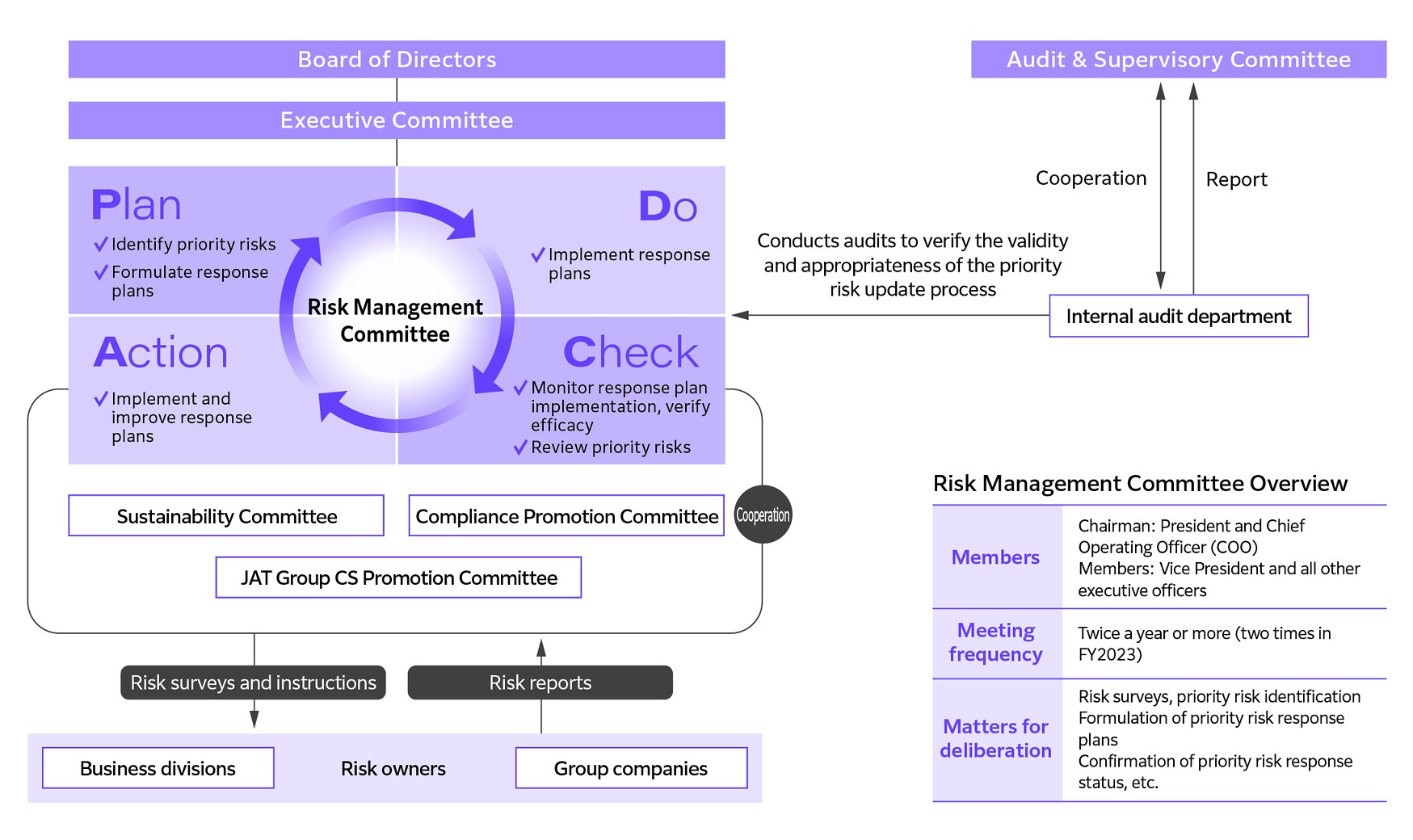

Risk Management Structure

For the Group, which is responsible for the construction, management, and operation of passenger terminals of a highly public nature, ensuring the continuity of our business is a social mission, and we recognize that in an uncertain society where new risks are emerging, understanding the risks surrounding our business and taking countermeasures are important issues in ensuring organizational resilience. We recognize that understanding the risks surrounding our business and taking countermeasures are important issues for ensuring the resilience of our organization.

In April 2023, we established the Risk Management Committee, chaired by the President and COO, in order to enhance the sophistication of our group-wide risk management system. The Committee determines priority risks and countermeasures to them, and has a system for repeatedly reviewing the status of responses and verifying their effectiveness. The deliberations of the Committee are reported to the Board of Directors as necessary, and risk management is supervised by the Board of Directors.

Business and Other Risks for the JAT Group

The Group has identified as business and other risks described below. In order to minimize the business impact of these risks, The Group has diversified its revenue structure by region (Haneda Airport, Narita Airport, etc.) and by segment (facility management, merchandise sales, and food & beverage). We are also strengthening our efforts in new businesses. In addition, we are striving to strengthen the Group's corporate structure and enhance its overall strength by strengthening measures to address the increase in operating expenses in each business field.

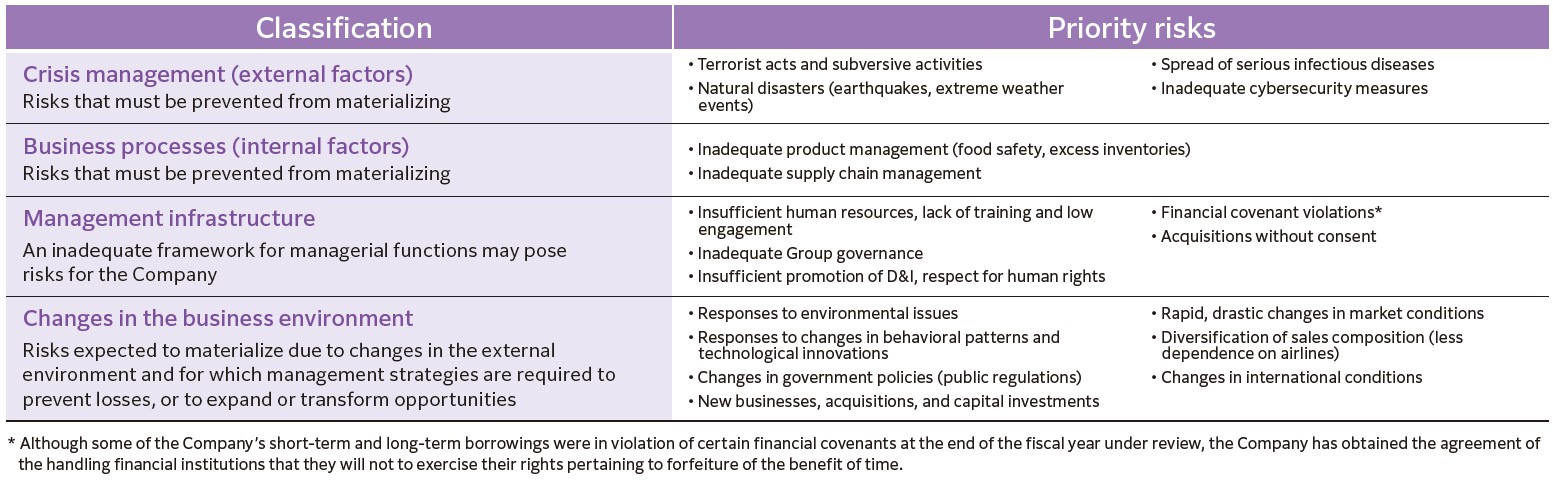

1.Crisis management, Business processes

"Risk Management and Business Processes" is a classification of risks that must be prevented from materializing in the course of business operations.

The Group is committed to disaster prevention, crime prevention, and accident prevention so that passengers can use the passenger terminals safely and comfortably, and we always pay the fullest attention to merchandise management and supply chain management in conducting our business operations. However, the following events could significantly impact the Group's business results and financial position.

・In case of a terrorist act or subversive activity that causes personal or property damage to the airport or passenger terminal.

・In case of natural disasters such as earthquakes and extreme weather events that cause personal or property damage to the airport or passenger terminals, or flight cancellations.

・In case of a significant decrease in airline demand due to the spread of a serious infectious disease.

・In case of leakage of personal Information , or serious failure of the information system or communication network operated by our group.

・In case of quality assurance problems such as food poisoning or contamination by foreign substances in restaurants, stores, etc., resulting in damage to the corporate image or administrative penalties, etc.

・In case of difficulties in obtaining foreign-made materials, disruption of logistics, or deterioration of reputation due to inappropriate procurement activities.

(Correspondence to COVID-19)

Against the pandemic of COVID-19, the Group had been working to ensure the safety and security of airport users and employees by improving ventilation capacity in the terminal, placing disinfectant solution throughout the terminal building, installing droplet infection prevention sheets, and introducing thermography at security checkpoints, in accordance with the “Guidelines for Prevention of the Spread of COVID-19 in the Aviation Field” (jointly prepared by the Scheduled Airlines Association of Japan and the All Japan Airport Terminal Association).As support measures for airlines and tenants, rent reductions and exemptions were implemented from April 2020, while reviewing the details according to passenger trends.

These factors have had a significant impact on the Group's operating results, including decreases in rent income, facility usage fee income, parking lot income, lounge sales, merchandise sales, and food and beverage sales.

In response to this, in terms of income and expenditures, in addition to reducing non-essential and non-urgent costs, we reduced facility maintenance and management costs by closing part of the terminals in line with passenger trends and reviewing our operating methods, and we reduced outsourcing costs by bringing operations in-house.

In terms of personnel expenses, the Group reduced fixed costs by partially returning executive compensation, reducing employee bonuses and temporary salaries, and other measures.

On the financial side, the Group taken measures to avoid the risk of a shortage of funds due to a decline in revenue in addition to the existing commitment line agreement of ¥9 billion, by procuring ¥5 billion in long-term debt and establishing a short-term borrowing facility of ¥20 billion by June 2020, and by raising a total of ¥56.7 billion through a public offering in March 2021.

In terms of business operations, to prevent the further spread of infection as well as to ensure the safety of passengers, business partners, and employees, the Group implemented basic preventive measures such as sanitation and disinfection in all areas of the passenger terminal, as well as thorough physical condition management of employees, staggered work hours, teleworking, promotion of web conferencing, and restrictions on business travel.

2.Management Infrastructure

"Management Infrastructure" is a classification of risks that may become risks in themselves if they are not adequately maintained.

In order to manage the Group must have appropriate recognition of the high level of safety and public nature of the passenger terminal business, as well as an understanding of the critical management resources that are the source of the Company’s corporate value (highly original technology and know-how, knowledge and information in specific market fields, deep relationships of trust with business partners cultivated over a long period of time, high-quality human resources with expertise in specialized fields, etc.).

In accordance with its medium-term business plan, the Group is working to promote DX, strengthen its organization, human resources, and governance, and reinforce its management base through financial strategies. However, the following events could significantly impact the Group's business results and financial position.

・In case of situations where store operations, introduction of new technologies, or promotion of new businesses are restricted due to a shortage of human resources, etc.

・In case a situation should arise regarding the lack of coordination of information and penetration of head office policies between the head office business units and group companies.

・In case of situations that may damage the corporate image in terms of ensuring diversity and respect for human rights, such as lack of personalized and diverse services, forced labor or child labor in supplier products, etc.

・In case the Company violates the financial covenants attached to the syndicated loan agreement concluded with the financial institutions concerned due to a downgrade of the Company's credit rating beyond a certain level, etc., and a situation should arise in which the Company loses the benefit of time.

Although some of the Company's short-term and long-term borrowings were in violation of certain financial covenants at the end of the current fiscal year, the Company has obtained the agreement of the handling financial institutions not to exercise their rights pertaining to forfeiture of the benefit of time.

・In case of control of the Company's financial and business policy decisions by an inappropriate person, resulting in damage to the Company's corporate value and harm to the interests of the Company and, in turn, to the common interests of its shareholders.

3.Changes in the business environment

"Changes in the business environment" is a classification of risks that are expected to materialize due to changes in the external environment and for which management strategies are required to prevent losses or to expand or transform opportunities.

The core of the Group's business is highly dependent on airlines, which are its main leasing partners and major customers, and airline passengers, and the following events could have a significant impact on the Group's business results and financial position.

・In case of a situation should arise in which the Group's reputation among customers and business partners is damaged or the Group faces difficulty in procuring funds to address environmental issues, or if the Group is obligated to reduce greenhouse gas emissions, create a trading system, or impose charges or other cost-bearing regulations that are tightened.

・In case of a change in passenger behavior that results in a decrease in demand for air travel, or a change in purchasing methods due to technological innovation that results in a decrease in willingness to purchase at airport stores.

・In case the laws and regulations, systems, or airport management policies pertaining to airport building operations are changed by the government or administrative authorities, which are the establishment and administrators of airports.(Further progress is being made in the airport management reform being promoted by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) with the enactment of the Law Concerning Operation of Airports under National Management Utilizing Private Sector Capabilities.)

・If, as a result of investments in new businesses or the implementation of capital expenditures, political instability in overseas operations or a deviation from the assumed return on investment occurs.

・In case of sudden and drastic changes in market conditions, resulting in price hikes, sharp fluctuations in exchange rates, etc.

・In case the Group's dependence on aviation has not been alleviated due to a delay in diversifying its sales mix when air passengers at Haneda and Narita airports, its main business areas, decline.

・In case of a decrease in demand for international flights due to changes in the international situation, such as worsening Japan-China relations due to the Taiwan emergency.

(The Impact of the Situation on Russia and Ukraine)

The Russian-Ukrainian conflict has been protracted, and economic sanctions imposed on Russia by Western countries have caused slowdown in trade, which has had a significant impact on the global economy. Even before the situation, there had been concerns about the rapid increase in demand for crude oil and other commodities due to the recovery from the COVID-19 disaster, supply chain disruptions, accompanying sharp rises in material prices, inflation risk, and other issues, The recent Russia's invasion of Ukraine has caused resource and food prices to soar even higher, semiconductors to be in short supply, and the yen to depreciate in the exchange market.

In the Group's business, in addition to the impact on aircraft operations between Japan and Europe, there are concerns about increases in utilities, transportation costs, and food and beverage costs due to higher energy and food prices, as well as an increase in capital expenditures due to soaring costs of materials. In addition, the amount of investment in the Khabarovsk International Airport project, in which we participate, is small and will not have a significant impact on our business performance.